Polish Mink Farms

Key Points

This investment opportunity concerns 4 mink farms in Poland of the Dutch owned Cerestial Farming Group including a skin processing center, drying facility and feed kitchen with all the required equipment. All facilities provide ample capacity for the 4 farms and therefore offer a unique all-in-one package.

The 4 farms have a maximum production capacity of 650.000 to 700.000 pelts per year when there is a full occupancy of 140.000 females.

The 4 farms are offered for 20 Million Euro and include 22.000 female animals.

Additional working capital is necessary to reach maximum capacity.

Mink Farm Operations

Breeding

The mink production cycle starts in the beginning of march, when the

minks’ natural mating season commences. The mating season lasts for two weeks. The minks’ mating process is promoted by maintaining a heat cycle controlled by lamps. After mating at the end of March the males and any females who have not mated are used for their pelt.

Whelping

The duration of a minks’ pregnancy differs from 40 to 70 days as development of the embryo does not begin until the eggs have appeared. Minks tend to give birth between April 25th and May 10th. Litter size can vary from 3 to 13 kits, but averages around 4 to 5 kits. In large litters it can be necessary to cross foster some of the kits (baby minks) to other dams (mother), because a dam can have difficulty taking care of a large litter. The first 4 weeks the kits are actively raised and fed by the dam. When the kits are 4 weeks old, they start to eat on their own, taking pressure off the dam. During the growing season, a pup eats about 230 grams of feed per day.

Weaning and Growth

Around July 1st the kits are paired off, male and female, to ensure normal behavioral

development. The dam and kits are fed offal collected from nearby slaughterhouses. Mink food consists in 85% of chicken offal supplemented with premix, cereals and vitamins during the summer period. At the end of august the minks are full grown; any further

growth can be attributed to fat gain.

Furring and Sale

The breeding stock for the following year is selected at the end of October. Selection criteria

are based on size, health, behavior and pelt quality. Animals which are not selected for breeding are pelted. The pelting season starts in November/December. After the pelting process the skins are placed on drying boards to maintain quality. Any byproducts of the pelting process are recycled for bio diesel, among other purposes.

After the furs have been made ready for the sale process, they are shipped off to auction houses.

When the furs arrive, the auction house has a 4-5-day inspection period. This enables

prospective buyers to inspect the furs and ensure quality requirements are met. The main point of sales of this business is NAFA (North American Fur Auction) and in Europe SAGA furs (Helsinki).

The Mink Fur Market

The Mink Market is inherently volatile alternating between periods of high and low prices but on average offers healthy returns.

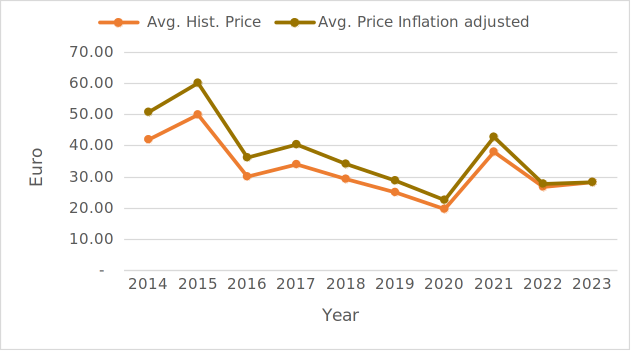

Average auction mink pelt sales price trend at historic and current prices

The last 7 years this volatility in price has been more exaggerated due to imbalances in supply and demand.

Yearly world demand (excluding China internal market) has been fairly constant at 35 million pelts for last 20 years.

Covid-19, legal measures and the termination of auction financing to breeders has caused many suppliers esp. in the Netherlands and Denmark, to exit the market, bringing max capacity (ex. China) down to currently about 6 million pelts which will gradually but not drastically go up again in coming five years until equilibrium is reached again at perhaps 15-20 million pelts.

Stocks have dwindled to about 10 million pelts adding to price pressure.

The new average price is set to stabilize at a higher price point than the historical average price of 42 euro over the period 2014-2019.

Currently the market is positively changing as China is has opened up again after a long Covid-19 lockdown. The prices of the last auction in March 2023 showed an upward trend again (see: Saga March 2023 Auction Results).

The changed market conditions have led to a situation in which less suppliers must fulfill demand that is returning to normal levels. According to industry experts, this supply gap, will possibly result in a price range from 50 to 90 euro per pelt especially in the coming five years.

Projected IRRs

The project has good to excellent profitability depending on the development of the pelt price and how quickly the livestock is expanded to maximum capacity even when the farms are divested in 10 years' time. The following tables shows the projected IRRs for different expansion rates and different average pelt prices. The conservative average price level of € 41.80 is equal to inflation adjusted average price of the pre-Covid period from the year 2014 up to and including 2019.

Table: IRR projections for different expansion rates and prices

| Expansion Rate (year:occupancy) | Pessimistic Price: € 35 | Conservative Price (pre-Covid average): € 41.80 | Optimistic Price: € 50 |

|---|---|---|---|

| 2024:100% | 7% | 16% | 26% |

| 2024:50% 2025:100% | 7% | 15% | 24% |

| 2024:50% 2025:75% 2026:100% | 7% | 15% | 23% |

| 2024:40% 2025:60% 2026:80% 2027:100% | 6% | 14% | 22% |

Unique Value Proposition

- Very healthy returns even at a very conservative (historical average) price projection.

- Real possibility of making a ‘killing’ in coming five years before equilibrium is reached as market is obviously at a turning point and there will be supply shortages in coming five years.

- Low systemic risk due to a clear exit strategy. IRR for 10 years operations and exit with repurposing of farms is still excellent because of live stock permits and good locations. Should mink farming be forbidden (not expected in the short term in Poland) government of Poland as an EU member will fully compensate owners.

- Proven management and operation track record means low operational risk.

For more information see the Investment Presentation (requires login).